At Horter, we stand by our client-centric, goals-based, risk-managed approach to investment management. We’ve spent decades developing and refining a comprehensive suite of portfolio solutions. This provides you with a full range of options as we custom-design your portfolio around your goals, manage the risks, and navigate through all stages of life and market fluctuations.

At Horter, “goal-based investing” is a key tenet of our investing belief system. Instead of promoting someone else’s top performing strategies, managers, funds, or ETFs, we believe in a disciplined, portfolio design process to help ensure we have an investment portfolio that matches the clients goals, objectives, risk tolerance and time horizon.

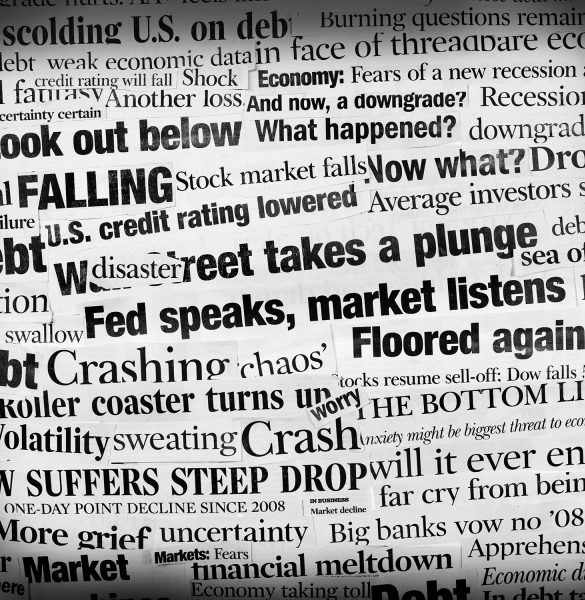

Ask yourself, if given a choice, do you really want to remain fully invested the next time the bears start to growl on Wall Street? Does it make sense to simply close your eyes and be forced to accept the full “rage” of the next nasty bear market cycle?

Our answer is a resounding NO. We believe that managing the risk associated with severely negative market cycles is an important part of what we call “modernized portfolio diversification.” In short, our goal is to lose the least amount possible during bear markets.

Free Portfolio Risk Analysis

A great many financial advisors adhere to “Modern Portfolio Theory” (MPT) when designing client investment portfolios. However, MPT isn’t very modern anymore – MPT was introduced back in 1952. Before personal computers. Before cell phone trading apps. And obviously before high-speed trading algorithms.

If we’ve learned anything since the turn of this century, it is that in our opinion using such old-school asset allocation techniques simply cannot keep up in today’s fast paced, highly correlated markets.

At Horter, we focus on a high tech, real-time approach to designing and diversifying portfolios. Whenever possible, we employ risk mitigation techniques as well as multiple investing methodologies, strategies, and managers.

Horter’s investment committee brings together a wealth of portfolio manager expertise and experience. With more than 75 years of combined portfolio design and investment management experience, the team has managed money through good times and bad.

We understand that everyone is different! We are not trying to push product or make commission like the standard Wall Street advisor. We listen, engage, and get a good sense of where your money should be, whether that means stocks, bonds, annuities or something else. The financial solution we offer you won’t be the same one that we offer everyone else. Your needs are unique, so we customize plans and investment choices that fit you.

A diverse team of money managers monitor our investment models daily. We continually manage and review their performance. You will have full transparency into your accounts at all times, and we will assign a designated IAR Support Specialist to you personally.

We work with third party custodians: TD, Schwab, AXOS, Nationwide, and TradePMR, with a few others under consideration. Your funds/assets are not in custody directly with Horter.

Our advisors want to work with any individual that has a goal of growing their assets and developing an overall comprehensive investment strategy. We don’t set minimums and are happy to discuss this with you.

The best way to see if we’re a good fit is to have a conversation. Call, email, or fill out the form below to speak with one of our team members. We’ll get in touch as soon as possible.